Article by: Watson Farley & Williams

WHERE ARE WE NOW?

Nearly a year on from the publication of the UK’s Hydrogen Strategy in August 2021 (see our analysis here), what progress have we seen? With commitments through to 2030, we focus here on the promises that the Hydrogen Strategy made for 2021/2022. These should, of course, be considered in light of the increasingly ambitious targets set out in the British Energy Security Strategy published in April 2022 (see our analysis here); it doubled the capacity ambition set out in the Hydrogen Strategy, with the goal now increased to 10 GW of low carbon hydrogen production capacity by 2030, with at least half of this coming from electrolytic hydrogen.

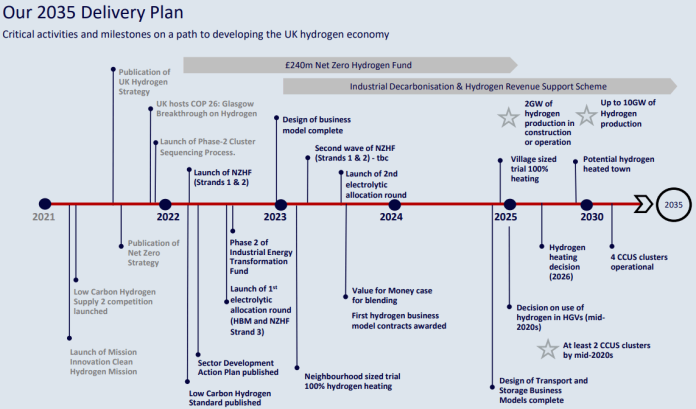

In a separate publication on 8 April 2022, the Hydrogen Investor Roadmap, the UK Government (the “government”) summarised the policies “designed to support the development of a thriving UK low-carbon hydrogen economy”. Stakeholders may find this a useful tool for tracking progress. It includes (on page 5) a delivery plan that may be useful to refer to alongside our analysis that follows:

By the “end of 2021”, the Hydrogen Strategy committed the UK government (the “government”) to the following measures.

| Commitment | WFW Comment |

|---|---|

| Launch a call for evidence on ‘hydrogen-ready’ industrial equipment. | A call for evidence that was more limited in scope (boilers only) launched 20 December 2021 and closed on 14 March 2022. Halfway through 2022, responses were still being analysed by government. |

| Launch a £55m Industrial Fuel Switching competition in 2021. | Done in August 2021, on the date the strategy was published. |

| Aim to consult in 2021 on ‘hydrogen-ready’ boilers by 2026. | The only consultation was for industrial hydrogen-ready boilers, rather than domestic ones. As set out above, this consultation closed on 14 March 2022, and a response has not yet been published. |

| Launch a call for evidence on the future of the gas system in 2021. | No update as of publication of this article. |

| Set out further detail on the revenue mechanism which will provide funding for the Low Carbon Hydrogen Business Model in 2021. | The proposed pricing mechanism was set out in the Government response to the consultation on a Low Carbon Hydrogen Business Model, published in April 2022.

Indicative Heads of Terms for the business model contract were published alongside the response. |

| Establish a Hydrogen Regulators Forum in 2021. | According to parliamentary questions, this met for the first time in January 2022, though it does not yet have a separate internet presence. |

Policy and regulatory direction regarding the future of the gas systems in the UK will be a key step toward providing clarity and certainty for investors and stakeholders. It will also be important for the government to allow stakeholders to air their views and concerns, and to take steps to address these. Given the government’s reliance on the market and industry participants to meet its decarbonisation targets, it will have to ensure that industry voices are heard and that barriers and challenges are addressed to enable stakeholders and investors to overcome them and deliver. Halfway through 2022, we have not yet seen the promised Call for Evidence referred to in the table above, which is no doubt eagerly awaited.

The government response to the consultation on a Hydrogen Business Model (the “Business Model Response”) also referred to in the above table confirms the intention to proceed with a contractual, producer-focussed business model, which will apply to a range of hydrogen production pathways (though it is not intended to support existing producers seeking to retrofit using carbon capture, usage and storage technology, nor the production of by-product hydrogen).

“The Business Model Response highlights that this was broadly welcomed by respondents, though some felt that the mechanism ‘would be too complex for small, electrolytic projects and therefore these respondents would prefer a fixed premium or fixed price for early projects’.”

The proposed revenue mechanism is a Contracts for Difference (“CfD”) style variable support mechanism. The Business Model Response describes this premium as being “calculated as the difference between a ‘strike price’ (to enable producers to cover costs) and a ‘reference price’ (price received by the producer) for each unit of hydrogen sold” (page 21). The Business Model Response highlights that this was broadly welcomed by respondents, though some felt that the mechanism “would be too complex for small, electrolytic projects and therefore these respondents would prefer a fixed premium or fixed price for early projects” (page 22). Despite the reservations expressed, government noted “the strong support from respondents for the minded to position of providing price support via the variable premium mechanism, and will proceed with this proposal” (page 23). The key, of course, will be setting the right reference price, recognising that all of the options proposed (in the absence of a market benchmark) had some drawbacks. The Business Model Response confirms the government’s intention to proceed with a model for initial projects that has three components:

- the producer’s achieved sales price;

- a price floor at the natural gas price to prevent producers from receiving additional support below that price; and

- a contractual price discovery mechanism to incentivise producers to increase the achieved sales price and avoid sales remaining at the natural gas price floor for the duration of the contract (allowing the subsidy to reduce over time).

In addition to pricing support, it is worth noting that the Business Model Response also envisages volume support through a ‘sliding scale’ mechanism – this would manage volume risk through paying a higher level of price support on low offtake volumes, with the level of price support tapering off as volumes increase.

“The government is working with the Low Carbon Contracts Company (the counterparty for the CfD) to understand how a future counterparty for hydrogen contracts could support producers to minimise administrative burdens and address confidentiality issues associated with the achieved sales price.”

As ever, the devil is in the detail, and the Business Model Response notes that it “will proceed with developing the detailed design of this proposed approach” (page 28). There is also an acknowledgement that the approach has moved away from the low carbon electricity CfD “due to the nascent nature of the hydrogen economy” (page 28). Nevertheless, the government is working with the Low Carbon Contracts Company (the counterparty for the CfD) to understand how a future counterparty for hydrogen contracts could support producers to minimise administrative burdens and address confidentiality issues associated with the achieved sales price.

The indicative Heads of Terms published alongside the Business Model Response provide a framework for the principal terms and conditions that are expected to be included in the Low Carbon Hydrogen Agreement (the business model contract). These are stated to be preliminary and indicative only at this stage and are subject to further development by Department for Business, Energy and Industrial Strategy. There are many similarities with the Contracts for Difference terms and conditions for Allocation Round 4, although how these will be adapted for a hydrogen-specific context remains to be clarified.

Hydrogen producers and other stakeholders will no doubt be interested to see that the government launched its first joint Hydrogen Business Model and Net Zero Hydrogen Fund (“NZHF”) allocation round on 20 July 2022 (see further in relation to the NZHF in the table below). The government hopes to support at least 250 MW of hydrogen capacity through this first round and projects will be entitled to apply for Hydrogen Business Model revenue support only, or joint Hydrogen Business Model support and CAPEX support through the NZHF. Projects are required to submit expressions of interest by 7 September 2022 in order to take part in the round, with final applications due by 12 October 2022. Alongside the launch of the allocation round, the government also published its response to the consultation on the Hydrogen Business Model and NZHF: market engagement on electrolytic allocation.

While the Hydrogen Regulators Forum (referred to in the table above) has been launched, public information is scarce. Stakeholders and investors alike will no doubt be keen to understand the Forum’s remit and how they can engage with them, particularly as it is a body that could take the lead in educating industry as the hydrogen economy develops (from lenders to investors and developers). Many questions still need answers: who are they? What is their remit? Will terms of reference be published? Who set them up and when?

The Hydrogen Strategy also made a number of commitments to be delivered by “early 2022”.

| Commitment | WFW Comment |

|---|---|

| Launch of a £240m Net Zero Hydrogen Fund (“NZHF”) for co-investment in early hydrogen production projects to support commercial deployment. | A notice launching the NZHF was issued on 18 May 2022 and updated on 9 June 2022. The first two funding competitions under the NZHF closed on 22 June and 6 July 2022 respectively. Also see our comments above in relation to the joint Hydrogen Business Model and NZHF allocation round. |

| Finalise the design of a UK low carbon hydrogen standard (“LCHS”). | A government response to the LCHS consultation was published on 8 April 2022, alongside draft guidance setting out emissions reporting and sustainability criteria, which has now become final. |

| Provide further detail on the production strategy and twin track approach (supporting electrolysis and CCUS). | An update on hydrogen production and use of CCUS was provided in the July 2022 Hydrogen Strategy update to the market. |

| Review systemic hydrogen network and storage requirements in the 2020s and beyond, including a need for economic regulation and funding, and provide an update. | An update on hydrogen network and storage requirements was provided in the July 2022 Hydrogen Strategy update to the market. |

| Assess market frameworks to drive investment and deployment of hydrogen and provide an update. | An update on creating a hydrogen market and driving investment and development was provided in the July 2022 Hydrogen Strategy update to the market. |

| Assess regulatory barriers facing hydrogen projects and provide an update. | No update as of publication. |

| Prepare a Hydrogen Sector Development Action Plan, including for UK supply chains. | The plan was published on 20 July 2022, which seeks to highlight the nature and scale of opportunities across the hydrogen economy in the UK, focussing on four key areas: investment; supply chains; jobs and skills; and exports. |

In its response to the LCHS consultation (the “LCHS Response”), the government has started to set out its policy design for the UK LCHS. Hydrogen producers seeking government support (such as the NZHF and Low Carbon Hydrogen Business Model funding) will need to prove compliance with the LCHS in order to establish eligibility. The LCHS will cover the methodology for UK production pathways only at this stage, although the LCHS Response notes that the government intends to set up a hydrogen certification scheme by 2025 to support future international trade. Projects applying for government support will be required to demonstrate that they satisfy the LCHS at the point of applying for said support, and, depending on the government scheme in question, they may also be required to prove ongoing compliance with the LCHS.

The LCHS guidance published alongside the LCHS Response is a key document that sets out requirements for projects that wish to access government funding support, including a detailed methodology for calculating the emissions associated with hydrogen production. Effectively, hydrogen producers will be required to meet a greenhouse gas emissions intensity of 20gCO2e/MJLHV (Lower Heating Value) of hydrogen or less for the hydrogen to be considered low carbon. The guidance will be updated at designated review points, as stated in the LCHS Response published alongside the guidance. This is because government “will need time to understand how the standard will work in practice” (page 5). Any updates to the LCHS will not have retrospective effect to projects that obtained funding during earlier competitions.

“A key point to note is that additionality is not required for hydrogen projects to meet the LCHS; this means that projects applying for funding do not need to be new projects, and so stakeholders who see opportunities to retrofit or refurbish older plants to produce low carbon hydrogen can participate in the open funding competitions.”

A key point to note is that additionality is not required for hydrogen projects to meet the LCHS; this means that projects applying for funding do not need to be new projects, and so stakeholders who see opportunities to retrofit or refurbish older plants to produce low carbon hydrogen can participate in the open funding competitions. This is a wise approach as it enables faster deployment of new hydrogen technologies while also cutting down emissions from existing plants.

The Hydrogen Strategy update to the market published in July 2022 flagged two key steps in clarifying the future of hydrogen transportation and storage (“T&S”) infrastructure:

- government’s intention to “publish a consultation to seek stakeholders’ views on hydrogen T&S infrastructure to support the design of the business models”, which is expected “to include questions on high-level options for timings, funding and wider economic regulation for this infrastructure” (page 7). This consultation is expected later this year; and

- a new Working Group on hydrogen T&S infrastructure under the Hydrogen Advisory Council, which is in the process of being set up. It will focus on funding and economic regulation, and will be made up of a representative group of stakeholders across the hydrogen value chain.

WHAT HAPPENS NEXT?

So, in summary, we are halfway through 2022 and, while some progress has been made, we have not seen all that was promised. Nor is it clear where the sticking points are, or whether other workstreams have overtaken the above.

What comes next? The 2021 Hydrogen Strategy committed to delivering the following “in 2022” or by “late 2022”:

- finalise the Hydrogen Business Model in 2022, enabling first contracts to be allocated from Q1 2023; and

- launch a call for evidence on phase-out of carbon-intensive hydrogen production in industry.

We look forward to seeing what the outcome of this will be, but we’re not holding our breath for delivery in 2022. Realistically, we expect to see these in 2023 at the earliest.

In the meantime, we have seen enough developments since the publication of the 2021 Hydrogen Strategy in August last year to be sure that the government is still committed to driving forward the hydrogen economy.

Particularly welcome is the launch of the Net Zero Hydrogen Fund and the finalisation of the Low Carbon Hydrogen Standard. These building blocks will hopefully accelerate hydrogen R&D, leading to earlier commercialisation of new technologies and business models, which will in turn present opportunities for investors who are waiting for a clearer picture to emerge.

As and when the promised consultations and calls for evidence come forward, there is still an opportunity for industry stakeholders to contribute and air their views and concerns.

If you have any questions about or are impacted by the above, please reach out to the article authors or your usual WFW contact.